Is ANY Health Insurance a Good Idea?

Permalink

While there is a battle raging over the "public option," a kind of Medicare for all,

there is so much disinformation and so many outright lies being spewed into the air, there

some fundamental truths that are being lost. Here are a few facts for anyone who still cares

about facts.

There are roughly four ways countries can run their health systems, to wit:

- Nationalized medicine

- National health insurance

- Regulated fee-for-service medicine

- Unregulated fee-for-service medicine

Some countries have one or the other. The U.S. has all four.

First, there is nationalized medicine. The British National Health Service operates like this.

The government (slightly indirectly) runs the hospitals and pays the doctors, who are government employees

or contractors. Here is more about its structure.

Despite what some tea-baggers are yelling at the tops of their collective lungs, none

of the five bills floating around Congress propose anything remotely like this. It would

be totally un-American--except for our troops, all of whom we support and want to give

the best care to. The Veterans Administration runs something pretty close to this, with

government-run hospitals and care. While some failures

have been well documented, few veterans are calling for the system to be chucked out

as socialism in disguise.

Second, there is national health insurance. This is what Canada has. Canadian doctors

and hospitals are private (or run by local or provincial governments). Basically, the

system is fee-for-service, but with everyone covered by the provincial governments but with federal money in

some cases.

In other words, the insurance system has been nationalized but the medical system itself is largely private.

What the government does is pay the bills.

Medicare works like this.

Third, there are countries where the system is entirely private (e.g.

Switzerland, as Paul Krugman

pointed out today).

Another example is The Netherlands, which Krugman didn't mention and which illustrates model 3

very clearly. The government's role there is largely to set the ground rules and make sure

they are enforced. In a nutshell, the key rules are:

- Nobody forces any company to offer health insurance. They do it only if they can make a profit on it.

- Health insurance companies must offer a basic plan covering a list of government-mandated costs (doctors, hospitals, etc.). They can't say: we cover all surgical costs--and then in tiny fine print explain "But only

when the operation is performed by a barber-surgeon using leeches"

- Companies must insure anybody who shows up for the same price, regardless of medical history

- All companies operate nationally, set their own prices, and compete on price

- There is an individual mandate; anyone not insured must pay a tax of about what the basic plan costs

- For items not covered (e.g., alternative medicine), companies can do whatever they want

- Employers can bargain with companies to get small (e.g., 10%) discounts for their employees

The fact that all companies operate nationally and employers play only a small role means

there is real competition, which provides something of a brake on premiums.

The Massachusetts health system is similar to this.

Fourth, there is the fully free-market based system, where individuals, insurance companies,

and health providers can pretty much do whatever they want to. Most of the U.S. falls under

this regime.

But with all the noise about the public option, almost no one asks the most fundamental

question of all: "Is insurance even the right model to think about for health care?"

At least not until David Goldhill wrote a

must-read article

in The Atlantic. Goldhill's point is that the purpose of insurance is to pool

large number of people together and get them to pay small premiums to cover a catastrophic

event that will not happen to most of them. As an example, car insurance covers the costs of

accidents, which most people don't have very often. No company offers full automotive

insurance that covers accidents, gas, routine maintenance, parking fees, new tires, and all

other automotive-related costs. Instead, individuals buy these other items on the open market

and as a result tend to look at the price and quality of the products and services closely.

Fire insurance is another example of true insurance--pooled risk against an unlikely event.

Goldhill argues that the fundamental problem with the U.S. health system is that since

consumers largely do not pay for their own medical expenses, they don't care how much they

cost. This simple fact leads to excessive costs, bloated bureaucracies, and inefficent

delivery. Consumers think that medical services are free, since some distant and much-hated

insurance company is paying for most of them, so they never weigh need vs. cost. The

employer-based health care system is basically due to a mistake Congress made during World War II.

While there were stringent wage and price controls in effect during much of the war, fringe

benefits were exempt, so unions (which couldn't demand more cash) demanded free health insurance

and got it, and tax free to boot. This bit of history is the root of the problem.

True reform might go something like this. Employers simply get out of the health insurance

business altogether and give the $12,000 or so they spend per employee to their employees

as more salary. The government enacts laws like The Netherlands has to keep insurance companies

honest and make them compete nationally, and then people go out and buy insurance on this

newly competitive market. No public option is needed. If the government chooses as a matter

of public policy to subsidize health care, then the first $12,000 (or some other amount) of

money anyone spends on health care could be tax deductible, and direct subsidies could be

given to poor people (health stamps, sort of like food stamps) to enable them to pay their medical bills.

The intention would be to have health insurance cover only catastrophic illiness with

normal medical costs (seeing GPs and specialists and short hospital stays) being paid out

of the $12,000 raise now-covered employees get. All of a sudden, people care about

how much that MRI costs. Goldhill describes how when his wife needed an MRI, multiple

hospitals refused to tell him the cost. If consumers were paying for things like this out

of pocket, you betcha they would be telling. Many would be advertising their prices.

Could something like this work? Goldhill talks about LASIK (eye surgery that eliminates

the need for glasses). This procedure is almost never covered and there is vigorous

free market for it. The cost has dropped ten-fold since it was introduced as clinics are

forced to truly compete. If all medical providers had to compete for consumers' business,

prices would be driven down, too. The government's main job here would be to certify

providers to make sure they met high medical standards and publish the results. Getting a "D"

rating wouldn't be good for business and providers would act accordingly. Goldhill's

main point is that all the incentives are wrong now so we need to rethink the whole

idea of "insurance" as the model

(except for catastrophic illness, which is like having a car accident or your

house burning down).

The problem with all the bills in Congress now is that none of them attack the

problems of bad incentives and the customer being insulated from the cost of what

he is demanding. As a result, the percentage of GDP being spent on medical are is only

likely to increase and become even less sustainable.

One issue Goldhill doesn't discuss (because it is totally taboo) but is crucial to the

debate is the imaginary "death panel" Sarah Palin and Chuck Grassley are against.

A huge amount of money is currently being spent to keep Grandma, who is 85 and has

Alzheimer's, alive. Families want no expense spared to give her a couple more months--since

they are not paying for it. Suppose Goldhill's system were implemented and Grandma, or

more likely, her children and grandchildren had to decide how much expensive care she was

going to get--knowing that some or all of the care was coming out of their expected

inheritance. It is likely that in many cases 85-year-olds with Alzheimer's would not be

getting quadruple bypass operations. The family wouldn't stand for it if they were footing

(part of) the bill. They would be making god-like judgments about quality of life vs.

cost and probably in many cases would be a lot stricter than any imaginary government

death panels would be.

If you have gotten this far, now go read the

article.

Agree or disagree, it certainly raises some key points about whether insurance is the

right model here.

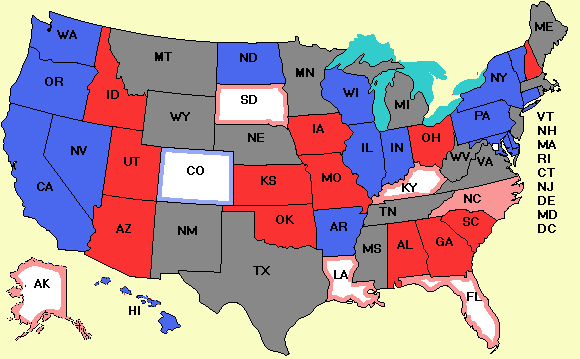

Doyle Not Running for a Third Term in Wisconsin

Permalink

Back from the philosophical to the mundane for a minute, Gov. Jim Doyle (D-WI) has

announced

that he will not run for a third term as governor of Wisconsin.

Most likely, Lt. Gov. Barbara Lawton (D-WI) will give it a shot for the Democrats.

The Republicans have a couple of plausible candidates, including former representative

Mark Neuman and Milwaukee County Executive Scott Walker, but others may get interested

as well now that Doyle is out of the picture.

If you like this Website, tell your friends. You can also share by clicking this button

-- The Votemaster

|

Your donation is greatly appreciated. It will buy ads to publicize the site.

|