• Republican Control of the Senate is Hanging by a Thread

• Congress Votes to Kick the Can into January

• Copy of Deciding Ballot in Virginia Obtained

• It's Trump Against the U.N.

• What Will the Consequences of the Tax Bill Be?

Thad Cochran May Resign Next Year

Politico is reporting that Sen. Thad Cochran (R-MS) is in poor health and may resign soon. Despite his powerful position as chairman of the Senate Appropriations Committee, which lets him determine how the government will spend its money, he hasn't given a speech on the Senate floor all year. He never talks to anyone about committee business. He has introduced only two bills this year, both minor. All "statements" he issues are in the form of written communications from his office, presumably written by aides. Senators who have seen him say he has declined, both physically and mentally. They are expecting him to resign from his committee chairmanship early next year, and possibly from the Senate as well. According to his office, he is healthy as a horse. However, this is the standard announcement for sick politicians until they have been clinically dead for 24 hours.

Cochran's decline is fairly recent. In 2015, he married one of his Senate aides, Kay Webber, after his wife died. There were strong rumors that Cochran was having an affair with Webber for as much as a decade before his wife passed. Mrs. Cochran had been living in a nursing home for 13 years prior to her death and suffered from dementia, so she probably wasn't keeping close track of what the Senator was up to.

Cochran's resignation (or death) would be bad news for Republicans. Cochran is a loyal member of his caucus and always does what Senate Majority Leader Mitch McConnell (R-KY) wants him to do. If his seat became vacant, Gov. Phil Bryant (R-MS) would appoint an interim senator until 2018. Then, there would be a special election to fill out the rest of Cochran's term, which ends in January 2021. That election would be in addition to the regular election in which Sen. Roger Wicker (R-MS), who was appointed to fill the seat of Trent Lott in Dec. 2007, is up for his second full term.

The problem here takes the form of a man named Chris McDaniel, who ran against Cochran in the 2014 and actually beat him in the first round of the Republican primary with 49.6% of the vote. Close, but no cigar in a state that requires 50.01% of the vote to be elected, so there was a runoff and Cochran beat McDaniel by a hair. McDaniel, egged on by Breitbart executive chairman Steve Bannon, is thinking about challenging Wicker next year. However, if there is a special election in which an inexperienced appointed senator is running, McDaniel might well decide that he has a better shot against him or her than against Wicker, who has now been in the Senate 10 years and has some seniority. Against Wicker, no Democrat has a chance, but McDaniel is so far to the right that with a strong candidate, Democrats could make it a close race. Republicans would far prefer that Cochran just stay in the Senate, even if they have to wheel him in from time to time to nod "yes" on a key vote, but the universe may have other plans for the 80-year-old senator. (V)

Republican Control of the Senate is Hanging by a Thread

After senator-elect Doug Jones is sworn in this January, Republicans will control 51 of the 100 seats in the Senate. History shows that is a fragile majority. For starters, Sen. John McCain (R-AZ) is battling an aggressive brain cancer and may not be available to vote on every bill. If he were to resign or die, there would be a special election in Nov. 2018 that the GOP could lose. Sen. Thad Cochran (R-MS) is also in poor health (see above).

These are known unknowns, but there are always unknown unknowns. Stuff happens. Let's look at some history. In 2001, then-Republican-senator Jim Jeffords of Vermont switched teams and became an independent, caucusing with the Democrats. That flipped control of the Senate. Could that happen again (yes, Susan and Lisa, we are looking at you)? In 2002, then-Democratic-senator Paul Wellstone died 11 days before the midterm election. Not entirely surprisingly, since there was no time to update the ballots, Norm Coleman won and became the 51st Republican senator.

In 1953, Republicans held a 48-47 majority after Oregon's Wayne Morse left the Republican Party and became an independent, not caucusing with the Democrats either. In the next two years, nine senators died. Two of those were replaced by a member of the opposite party. When Ohio's Robert Taft died, he was replaced by a Democrat, giving the Democrats a majority. Could something unexpected happen? Well, eight current senators are over 80, and as we said, stuff happens. (V)

Congress Votes to Kick the Can into January

By a largely partisan vote of 231 to 188, the House appropriated enough money to keep the government running until Jan. 19. Shortly thereafter, the Senate followed suit, by a slightly less partisan 66-32 majority. If Donald Trump signs the bill, and there's no reason to think that he will not, a government shutdown is averted for 4 weeks, but Democrats and Republicans are likely to be as far apart then on the budget as they are now, so a shutdown could happen then. Or Congress, in its wisdom, could kick the can into February.

There was a big push within the Democratic caucus to withhold support for the funding bill unless something was done about the Dreamers. Party leadership quashed that, at least for now. They decided, presumably, that their hand will be stronger when (1) They cannot be accused of ruining federal employees' Christmas, (2) They will have accommodated the GOP two different times on requests for "more time," and (3) They will have one more vote in the Senate. The GOP probably should have cut a deal on the Dreamers and found a way to get the budget done, because that demand isn't going away, and when the Democrats return to work in January, they may have discovered a few more demands they are willing to go to the wall for (no pun intended). (V & Z)

Copy of Deciding Ballot in Virginia Obtained

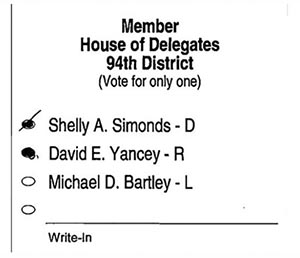

The initial count in district 94 of the Virginia House of Delegates race went to David Yancey (R) by 10 votes. In the recount, Shelly Simonds (D) won by a single vote. Her victory would have split Virginia's lower chamber exactly 50-50. But before the vote could be certified, a three-judge panel decided to count one contested vote for Yancey, making the race an exact tie. The Virginia Pilot obtained a copy of the disputed ballot. The vote for the race in question appears below:

The judges ruled that the slash through the Simonds oval meant that the voter changed his or her mind and wanted Yancey. No doubt they were influenced by the fact that in the three other partisan races on the ballot, the voter chose the Republican. Still, it is clearly a spoiled ballot and the judges could have simply invalidated it since more than one oval is filled in, in violation of the law. The winner will be chosen next Wednesday by lot. If Yancey wins, Republicans will control the House of Delegates. If Simonds wins, it will be equally divided. However, if Yancey wins, Simonds may sue on the grounds that the three-judge panel should have ruled that the ballot was invalid. (V)

It's Trump Against the U.N.

When Donald Trump announced that the United States would recognize Jerusalem as the capital of Israel, there was zero question that the international response would be overwhelmingly negative. World leaders and media outlets around the globe promptly denounced the decision in the days after it was made. On Wednesday, the U.N. Security Council voted 14-1 (with the U.S. as the 1) to condemn the decision. And on Thursday, the U.N. General Assembly (UNGA) voted 128-9 (with 35 abstentions) to second that sentiment. Besides the U.S. and Israel, the 9 included Micronesia, Nauru, Togo, Palau, the Marshall Islands, Guatemala and Honduras.

The U.N. resolution means absolutely nothing. It is non-binding, and all it does is state formally what everyone already knew: International opinion is overwhelmingly against the Trump administration's decision. Generally, under these circumstances, the U.S. just ignores the UNGA. Every year, for example, the body votes to condemn the U.S. embargo on Cuba and nobody pays any attention. However, this whole situation is theater for the benefit of the base. So, the UNGA resolution afforded an opportunity for some excellent posturing by U.N. Ambassador Nikki Haley, who declared:

The United States will remember this day in which it was singled out for attack in this assembly. We will remember it when we are called upon to once again make the world's largest contribution to the UN and when other member nations ask Washington to pay even more and to use our influence for their benefit.

Haley, of course, is doing exactly as instructed by the White House; earlier in the day Trump himself warned, "We're watching those votes. Let them vote against us, we'll save a lot. We don't care."

This kind of rhetoric will almost certainly send the base into spasms of delight. However, there is a downside to conducting foreign policy primarily for benefit of a domestic audience. Either Trump will have to follow through on the threats that he and Haley made, thus further damaging the United States' relationship with key allies (Egypt, France, Germany India, Ireland, Japan, the Netherlands, Turkey, and the UK all voted in favor of the resolution) or he will have to back down, thus announcing to the world—yet again—that he's a paper tiger whose threats and promises are meaningless. Who knew foreign policy could be so hard? (Z)

What Will the Consequences of the Tax Bill Be?

Congress leaves Washington today for its Christmas break. When they return in January, the new tax bill will be in effect, and it will be time to start thinking about the consequences. While the GOP has foreseen some of what will come next, there are undoubtedly a whole bunch of curve balls that they did not anticipate.

First, the economic impacts. There are many lawyers and accountants whose job is to find loopholes in the tax code, and some of them are very good at it, indeed. The ink is hardly dry on the bill, and already a team of academics has taken note of a number of loopholes ripe for the picking:

- Incorporate: Under the new tax code, corporations pay far less in taxes

than individuals. So, there will be much incentive for some individuals to incorporate. Joe the Plumber,

for example, could save himself thousands by becoming Joe the Plumber, Inc.

- From Employee to Contractor: Similarly, there will be much

incentive the in the new plan for some high-earning employees to become contractors whose salary

is instead paid to pass-through entities. A programmer working for Microsoft, for example,

will keep more of her income if she is Josephine Programmer, LLC.

- From Professional to Landlord: Income from employment is taxed

at a much higher rate than income from property rentals. This may encourage business owners

to charge themselves massive rent, cutting their higher-tax wages but increasing their lower-tax rental income.

- Blue States Fight Back: The new tax code is specifically designed to

stick it to high-earners in blue states. But the blue states' legislatures aren't likely to take

this lying down. For example, they might change the law so that payroll taxes are paid by

employers rather than employees. It would be the same money, but because it would be "paid"

by the businesses at their lower rate, it would reduce the total amount of tax withheld.

- Send Jobs Abroad: The new law allows corporations to

collect 10 percent annual returns on foreign factories and offices, tax free. Naturally,

this is going to provide much motivation to move jobs abroad. So much for Donald Trump's

claim that the bill would create "jobs, jobs, jobs."

- Rent Your Equipment: Businesses can write off equipment purchases and

rentals, including those made before the bill went into effect. In fact, particularly audacious

business owners might buy equipment, write it off, then rent it back to themselves, and write

it off again.

- A Borrower and a Lender Be: Borrowing money is disincentivized a bit in the new bill. But setting up an equity-interest partnership, where a business effectively borrows from itself, allows tax breaks on both ends of the transaction.

These are just the low-hanging fruit; there will undoubtedly be other kinds of loopholes discovered, and economic impacts felt, once the bill goes into effect. For example, Fortune warns of the resurgence of "conservation easements," wherein land is acquired, overvalued, and then donated to a charity or to a local government, thus generating a handsome tax write-off. CNN Money, relying on expert analysis, predicts the U.S. trade deficit is likely to get worse. And Politico suggests making an appointment with your accountant now, because it's going to be chaos at the IRS and at accountants' offices as they try to make sense of everything.

In addition to the economic impacts, of course, there will also be political fallout. GOP leadership knows this, and is planning the mother of all PR blitzes in order to rally support for the bill. They are also counting on a common dynamic in American politics, namely that new bills and programs gain in popularity once they are an established fact, and once enough time has passed for passions to cool. Obamacare, for example, followed this trajectory, rising over time from a net approval rating of -11.5 to +12, a swing of 23.5 points.

Undoubtedly, these notions will allow Speaker Paul Ryan (R-WI) and Mitch McConnell to sleep better at night during the holiday season. It is likely, however, that cold, hard reality will eventually force them to remove their rose-colored glasses. First of all, the GOP tax bill is unusually unpopular. In fact, it may be the most unpopular piece of legislation adopted since the advent of modern polling. Depending on which poll you believe, it's underwater by about 20 points. That means that even if there's an ACA-level shift in public sentiment, then the bill will only be 50/50, give or take a point ot two. That's not usually where a party wants to be.

Continuing on that line of inquiry, while the Obamacare parallel might soothe GOP nerves, Party leaders should take note that it took seven long years for public opinion on the ACA to shift from negative to positive. And in those seven years, the Democrats took a beating at the polls, particularly in the midterms of 2010. Most other programs that started out controversial and eventually became popular—Social Security, the Interstate Highway Act, the Civil Rights Act of 1964, etc.—took a similarly long amount of time to achieve acceptance. Meanwhile, completely transforming public opinion in under a year—particularly by 20-25 points, while relying on a historically unpopular president to be chief salesman—is all but unheard of. Abraham Lincoln did it with emancipation, but that was over 150 years ago. And Donald Trump seems rather unlikely to come up with a sales pitch quite as good as the Gettysburg Address.

There is also a very serious flaw in the specific pitch that the GOP plans to make to voters, something along the lines of "look at the extra money you're getting." Inasmuch as the members of Congress are a bunch of lawyers, while the President and his team are mostly business tycoons, they are surely not following the latest developments in the social sciences. If they had been, they might be aware of the research of Benedikt Herrmann, Henrik Orzen, and others. These folks are experts in, to use the layman's term, spite. They conduct studies in which participants are asked a series of questions like these:

- You have $100. You get $50 and Bob gets $50. Do you take the $50?

- You have $100. You get $30 and Bob gets $70. Do you take the $30?

- You have $100. You get $10 and Bob gets $90. Do you take the $10?

What these studies have demonstrated, over and over, is that at a certain point, people would rather have nothing than be party to an unfair split of resources. To describe this tendency, Herrmann and Orzen coined the term homo rivalis. And as we have pointed out several times, polls show that the overwhelming perception of the GOP tax bill is that it may help most people a little, but that it overwhelmingly helps the rich. As long as that is the perception, "look at the extra money you're getting" is not likely to be an effective pitch. In fact, it is likely to make homo rivalis angrier. Alternatively, the GOP could try to argue that the bill doesn't actually help the rich all that much. The problem is that Donald Trump has been loudly declaring that for a month, and nobody's buying it. Point is, the Republican spin machine has its work cut out for it in 2018. (Z)

Email a link to a friend or share:---The Votemaster and Zenger

Dec21 Winners and Losers from the Tax Bill

Dec21 Taxpayers Won't Know How the Bill Affects Them Until after the Midterms

Dec21 Obamacare Is Not Dead and Gone

Dec21 Next Up: Big Problems

Dec21 Democrats Open Huge Lead on Generic Congressional Poll

Dec21 Virginia House of Delegates Race Is an Exact Tie

Dec21 Nadler Will Succeed Conyers on the House Judiciary Committee

Dec21 White House Takes Petitions Offline

Dec20 House, Senate Pass Tax Bill

Dec20 Mystery Solved? Maybe "Corker Kickback" Was Actually "Hatch Kickback"

Dec20 Trump Could Do Something Worse Than Fire Mueller: Fire Rosenstein

Dec20 James Clapper: Putin is Handling Trump Like an Asset

Dec20 Of Dreamers and Fences

Dec20 Democrats Have a Southern Strategy of Their Own

Dec20 Democrats May Have Ended Republican Control of the Virginia House of Delegates

Dec20 Voters Hate Their 2016 Choices Even More Today Than a Year Ago

Dec20 Disney World Unveils "Donald Trump"

Dec19 House Will Vote on the Tax Bill Today

Dec19 Tax Bill Could Cost Over $2 Trillion

Dec19 What Are the Republicans Thinking?

Dec19 Many Big Fights Expected in Congress This Week

Dec19 Why Are Trump's Allies Attacking Mueller?

Dec19 Trump Lays Out National Security Strategy

Dec19 U.N. Vote Isolates the U.S. Even More

Dec19 People Die in Train Wreck; Trump Searches for Angle

Dec19 Another Judicial Nominee Bites the Dust

Dec18 Trump Is Not Considering Firing Mueller

Dec18 Last-Minute Perk for Real Estate Tycoons Ended Up in Tax Bill

Dec18 Congress May Shut the Government Down Despite Itself

Dec18 Trump Is Looking Forward to Campaigning in 2018

Dec18 McCain Is Increasingly Frail

Dec18 Jones Is Not Calling for Trump to Resign

Dec18 Cruz Is No Trump

Dec18 Voters Would Prefer Democrats to Control Congress

Dec18 Democrat Accused of Inappropriate Conduct

Dec17 White House Unhappy that Mueller Has Transition E-mails

Dec17 Trump Simply Does Not Accept Russian Interference

Dec17 GOP Base Seems to Like Tax Plan

Dec17 Centers for Disease Control May or May Not Be Barred from Using Seven Words

Dec17 Trump Discussed Disney Deal with Murdoch

Dec17 Kihuen Won't Seek Re-election

Dec17 The Truth Is Out There?

Dec16 Blackmail Works

Dec16 MacDonough: Thou Shalt Not Do Politics in Church

Dec16 What's in the Tax Bill?

Dec16 Democrats Will Use Net Neutrality to Energize Millennials

Dec16 Trump's Popularity Is Plummeting

Dec16 Woman Drops Out of House Race on Account of Sexual Harassment Charge

Dec16 Another Dubious Judicial Nominee